- What is accrual based accounting?

- The Key Differences Between Cash and Accrual Accounting

- How is the month end process different between cash basis accounting and accrual accounting?

- What types of accrual adjustments need to be made on a monthly basis?

- Are there different types of accrual basis accounting?

- Why It’s Easier to Run Your Agency With Accrual Financials

- Signs It’s Time to Switch Your Agency’s Accounting Method

- How should we recognize revenue under accrual accounting?

- When do we recognize expenses under accrual accounting?

- How does accrual accounting impact cash flow?

- How should we handle client retainers, deposits, or prepaid fees with accrual accounting?

- How will a switch to accrual accounting impact my tax return?

- Can QuickBooks Online handle accrual accounting or do I need another type of software?

- Will my accountant charge more for accrual accounting? Can I DIY it?

- Conclusion

Agency owners often ask whether they should switch to accrual-based accounting for better financial clarity and performance tracking. While the question seems pretty simple on the surface, the answer is usually more complex. This article explains accrual accounting, how it works, and when it makes sense for your agency to make the switch.

What is accrual based accounting?

Accrual accounting is the process of accounting for transactions as economic impacts occur.

For example, a contractor does work for you during the month of January. The contractor sends you an invoice on February 1st, net 30, and you pay the contractor on March 1st. Under accrual accounting, you would recognize the expense in your financial statements in January, not February (when you receive the bill) or March (when you pay the bill).

The Key Differences Between Cash and Accrual Accounting

Cash basis accounting accounts for transactions as cash moves, regardless of when the economic impact of those transactions happens.

Using the above example, the agency would account for the contractor’s expense in March, when the bill is paid. In other words, when the cash leaves the agency’s bank account.

Accrual accounting gives you a more accurate representation of the financial performance of your agency over the short-term. On a long enough time horizon, the full lifetime of the agency, both methodologies will provide the same aggregated result.

How is the month end process different between cash basis accounting and accrual accounting?

The biggest difference at month-end is the level of communication needed between accountants and agency leadership. Accountants must account for transactions that haven’t yet hit the bank, so they need to know what’s coming. Clear communication helps, but access to tools like your CRM and project management software can also fill the gaps.

The added data and communication lead to journal entries that ensure your agency’s monthly activity is accurately recorded.

What types of accrual adjustments need to be made on a monthly basis?

There are a number of entries that need to be made into the accounting software during the month-end close process. Most commonly we are booking the following for our agency customers:

- Payroll adjustments – making sure payroll is booked to the correct period. For instance, if your agency is on a bi-weekly pay cycle and the payroll cutoff is before the month end. In that case, you’ll need to accrue the portion of wage expense (and all the related benefits and taxes) that are incurred between your last pay date and month end and paid in the following month.

- Deferred revenue – cash that has been paid by customers but for which you have not yet done the work.

- Prepaid expenses – cash that you’ve laid out for products (e.g. software) or services that have not yet been fully utilized.

- Accrued expenses – expenses that have been incurred but not yet paid. Good examples are contractors and other passthrough expenses so we can match the expenses to the period in which they’re incurred. This helps with project profitability and overall agency profitability. Another good example is income taxes that will be paid in a subsequent month.

Are there different types of accrual basis accounting?

There are four main variants of accrual accounting:

GAAP & IFRS

GAAP stands for Generally Accepted Accounting Principles. IFRS stands for International Financial Reporting Standards. GAAP standards are issued by the Financial Accounting Standards Board, or FASB. Public companies use GAAP so financials follow the same rules and can be compared across businesses. FASB standards span 8,000–10,000 pages and are often complex to apply. Marketing agencies are private companies and for the most part, strictly applying GAAP is overkill. However, you’ll hear the term GAAP quite frequently, especially when reviewing boilerplate language in lawyer-prepared documents.

Modified Accrual Accounting

This is a blend of cash and accrual accounting that’s generally used for governmental funds. This variant does not apply to agencies.

Modified Cash Accounting

This is also a blend of cash and accrual accounting and the variant that we use with our marketing agency customers. Modified cash accounting is less formalized than modified accrual accounting. Under our version of modified cash accounting, we book the above listed entries on a monthly basis, but only for those entries that are material. Immaterial amounts are treated on a cash basis. For the remainder of this article, this is generally what I mean when I refer to accrual.

Tax Basis Accounting

Under this method, we are doing the accounting based on the tax code. If you file taxes on an accrual basis, you’ll need adjustments to align with tax code requirements. We only use this method to book depreciation, keeping agency financials consistent with tax depreciation rules.

Why It’s Easier to Run Your Agency With Accrual Financials

Accrual basis accounting makes it easier to run your agency. It allows you to have confidence that the numbers in your financial statements are truly indicative of the financial performance of your agency.

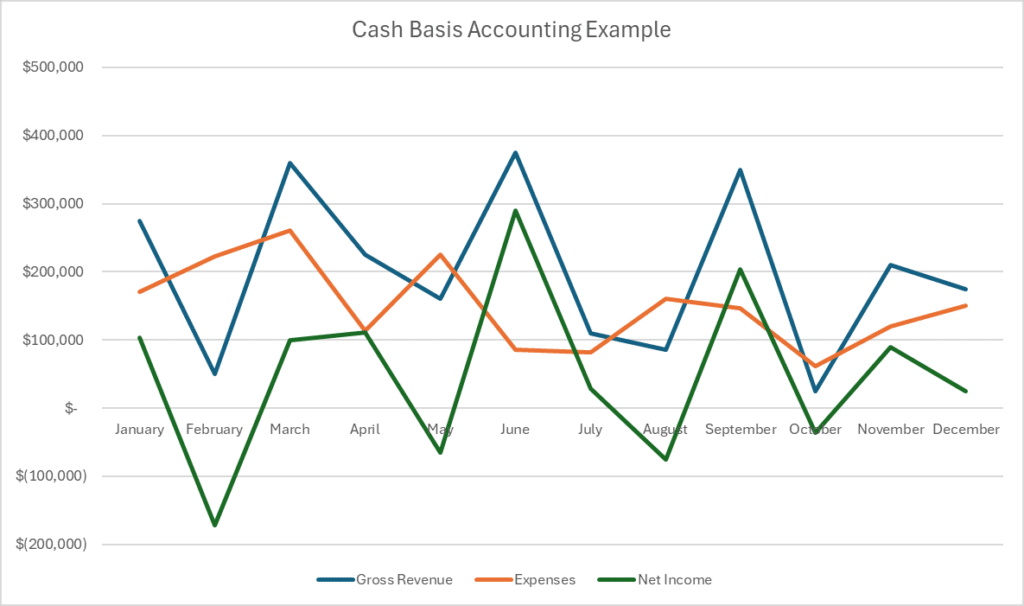

As an example, let’s look at the profit and loss (P&L) statement for an agency on both a cash and an accrual basis. The agency in question does $2.4M in revenue and net income of $600K on an annual basis. This is a graphical representation of what the P&L might look like using cash basis accounting:

This feels like chaos, right?

Some months show a net loss and expenses don’t seem to bear much of a resemblance to the levels of revenue being derived. Said another way, the cash flows of the agency don’t seem to have any connection to the financial performance of the agency. It’s difficult to manage a business when your cash flows bear no resemblance to your performance or what you’ve feeling in the business.

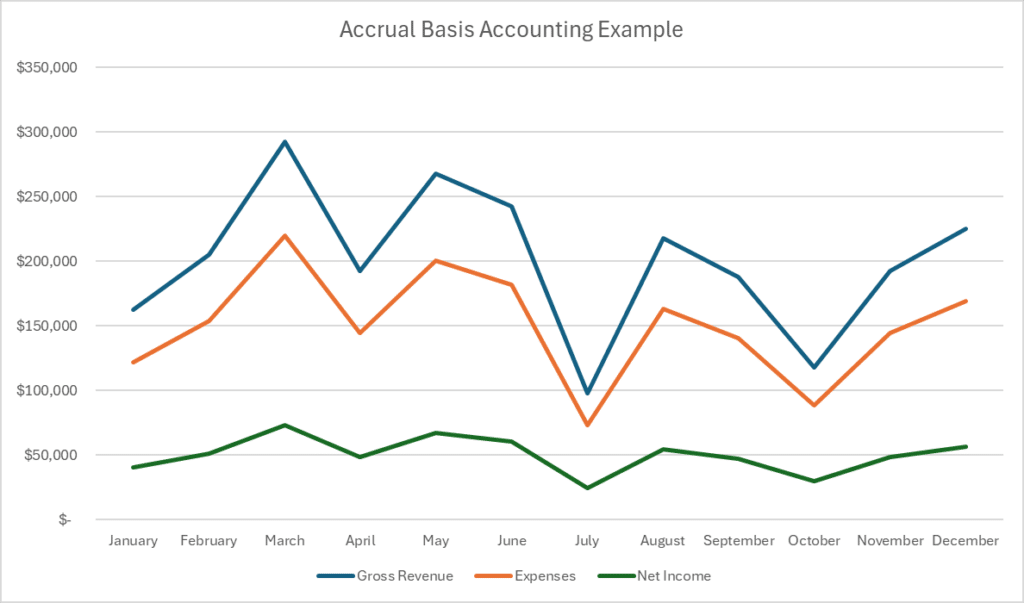

Contrast that with the same agency that’s keeping its financials on an accrual basis. The financials for that same agency might look something like this:

A lot different, isn’t it? The agency is much easier to run when you have clarity in your financials and your financials simultaneously bear a resemblance to what you’re seeing and feeling when operating the agency.

In addition to making your job as an agency leader easier, keeping your financials on an accrual basis will also help you getting your agency acquired. If you’re ever the target in an acquisition, the acquirer is likely going to ask you to restate your financials on an accrual basis pretty early in the process.

Why?

For the same reason that using accrual is helpful to you – because it more clearly represents the true financial results of the agency. Just as you want and need clarity in running your agency, an acquirer wants and needs financial clarity into a potential investment.

Signs It’s Time to Switch Your Agency’s Accounting Method

Generally, your agency should be approaching or above $1,000,000 in gross revenue when you’re considering making the switch. Accrual accounting requires additional expertise and systems than cash basis accounting does, and therefore will be more expensive. There is a cost-benefit analysis that must be done when considering making the switch.

You should consider making the switch if:

- The above statements resonate with you and you’re having a difficult time reconciling the operations of the business with what your financial statements are telling you, and/or

- You’re considering selling your agency in the relative near term, and

- You have the resources to put toward implementing and maintaining an accrual-based system.

How should we recognize revenue under accrual accounting?

The agencies that we work with generally derive revenue in some combination of the following ways:

- Monthly subscription or monthly fixed fee – this is the easiest method, as the revenue is simply recognized within a singular month. If the customer is billed following the month end, we recognize revenue in the prior month. If the customer is billed upfront, we recognize that revenue over the course of the current month.

- Retainer – revenue is recognized as hours are tracked against the retainer. For this type of revenue, time tracking is the generally the trigger.

- Project – this one is tricky. The trigger can either be a period of time (e.g. project beginning to project end), specific milestones outlined in the statement of work (SOW), and/or based on time tracking.

- Time – this is becoming less and less common. When billing by the hour, revenue is earned as the time is tracked and subsequently billed. This too, is fairly straightforward from an accrual perspective. Where it gets tricky is when a customer complains or an employee takes too long on a project and you have write-downs.

When do we recognize expenses under accrual accounting?

Expenses are recognized as they are incurred. For instance, if you pay $1,200 for an annual Zoom (software) subscription on January 1st, you will recognize $100 in expense in each month of the year. The full $1,200 will be booked as an asset (Prepaid Expense) on January 1st and then ratably expensed over the course of the year.

How does accrual accounting impact cash flow?

The only impact to cash flow will be the increased cost of implementing and maintaining an accrual accounting system.

That said, under the cash basis of accounting your P&L will more closely resemble your cash flow than an accrual basis P&L. When using the accrual basis, it’s extremely important to review not only your P&L and balance sheet, but your cash flow statement as well. The cash flow statement will reconcile what you’re seeing on your P&L with the cash inflows and outflows of your agency.

How should we handle client retainers, deposits, or prepaid fees with accrual accounting?

Let’s take these one by one…

- Retainers – assuming you’re setting up a new customer, the full amount of the retainer they pay you when the engagement starts will be booked to Deferred Revenue when you receive the cash. Deferred Revenue is the account to use when you’ve been paid money that you have not yet earned. Deferred Revenue is a current (lasts less than 12 months) liability on the balance sheet. As you complete work for the customer, you will recognize the revenue (on the P&L) and reduce the liability on the balance sheet. When the retainer is topped off by the customer, you will repeat the process.

- Deposits – deposits will work roughly the same way as retainers. Deposits turn into revenue whenever a triggering event gives the right to the money to you. At that point, it’s revenue to the agency.

- Prepaid fees – ditto.

How will a switch to accrual accounting impact my tax return?

The accountant’s famous answer: it depends.

If your tax returns are already filed on an accrual basis, there likely won’t be any impact. For those filing on a cash basis, it’s worth having a conversation with your tax advisor about whether switching to accrual makes sense. Should you decide to maintain cash basis for tax purposes while keeping your books on an accrual basis, your accountant will need to make adjustments to reconcile the two methods during tax preparation.

Can QuickBooks Online handle accrual accounting or do I need another type of software?

The short answer is “yes, QuickBooks Online (QBO) can handle accrual accounting for a marketing agency.” There’s no need to switch to a different general ledger (what QBO is) platform.

The longer answer is that you will need different processes, procedures and systems surrounding your accounting on an accrual basis vs. a cash basis. For instance, proper accrual accounting will be heavily dependent on monthly journal entries. By default, journal entries are a manual process and manual processes are ripe for errors. When we do accrual accounting for customers, we try to automate as many of the journal entries as possible.

There are a few other things you should know about accrual accounting in QuickBooks:

Journal Entries

Journal entries impact both cash and accrual accounting in QBO. Therefore, the journal entries you post for accrual purposes will also impact your cash basis books. If you switch to accrual, your cash basis books are likely irrelevant (see the tax return point above). To get back to cash from accrual accounting in QBO, adjustments will need to be made.

Reports

In QBO, reports, such as the P&L, allow you to toggle back and forth between cash and accrual. See above, though.

Invoices and Bills

These transaction types are included in accrual reports as of their document date. They’re included in cash basis reports as of the date they’re paid. Adjusting based on dates is not true accrual accounting, and simply running accrual basis reports in QBO does not mean that “you’re doing accrual accounting.” You’ll need to make further adjustments based on bills and invoices. For example, if you create an invoice dated 1/1 and earned over a quarter, you should recognize the revenue evenly across the three months. QBO’s default settings recognize it only in January. To record the revenue properly, you must create the invoice and make at least three additional journal entries.

Will my accountant charge more for accrual accounting? Can I DIY it?

Probably. As you can see from the above, accrual accounting for an agency is more than just switching your reporting from cash to accrual in QBO. It’s a lot more work.

Anything can be DIY’d, but proceed with caution. Accrual accounting requires far more expertise than cash basis accounting. Doing it poorly or incorrectly can quickly create a mess that you’ll have to clean up later.

Conclusion

In closing, accrual accounting makes it easier to run your agency. Accrual accounting is also a key step in getting your agency ready for a sale. While the benefits of accrual accounting are great, smaller agencies need to do a cost-benefit analysis to see if it’s the right time to make the switch. Accrual accounting demands more expertise and effort than cash basis, so work with a qualified professional to implement and maintain it for your agency.