- What are tax brackets?

- What are the current income tax bracket rates and levels?

- What is my tax bracket based on?

- How do tax brackets work?

- What is an effective tax rate?

- "I don't want my employer to pay me more money/a bonus because it'll put me in a higher tax bracket."

- What is the highest tax bracket?

- How do state income taxes work?

- Conclusion

A recent tax literacy poll conducted by the Tax Foundation found that over 50% of respondents didn’t know how income tax brackets work. Holy cow. Tax brackets can certainly be confusing, but they are at the heart of your tax planning strategy and need to be understood. That’s why we go over each customer’s tax bracket and effective tax rate (they’re different) with each tax return we deliver. Understanding both rates is crucial.

What are tax brackets?

A tax bracket is a dollar range of income to which a tax rate applies. “The tax brackets” is the collection of all of these ranges and rates.

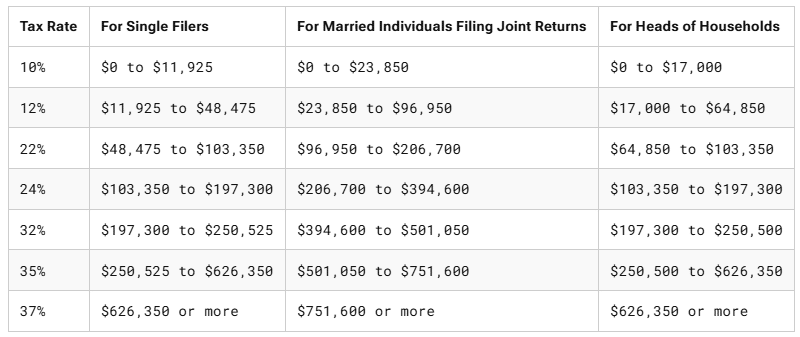

What are the current income tax bracket rates and levels?

Most tax professionals, myself included, do not have the tax brackets memorized. Plus, they change every year. I find myself Googling to find the tax brackets on a fairly consistent basis, and my favorite site is NerdWallet because they break it down so well. Having said that, a more consolidated look for 2025 is posted below from the Tax Foundation.

What is my tax bracket based on?

Your tax bracket is based on your taxable income. It is not based on your gross income nor your adjusted gross income (AGI).

How do tax brackets work?

Your taxable income moves through the various tax brackets until it gets to your last dollar of income. Your top tax rate is a marginal tax rate, meaning it’s the tax rate on the last dollar of income that you earned.

As an example using the chart above, if you’re a single filer with taxable income of $103,351 your tax bracket would be the 24% bracket. You’d have $1 that is taxed at that rate, and the other $103,351 would be taxed at lower rates.

What is an effective tax rate?

Because your taxable income moves through the various tax rates what you end up with is a weighted-average tax rate. Your weighted-average tax rate is otherwise known as your effective tax rate.

“I don’t want my employer to pay me more money/a bonus because it’ll put me in a higher tax bracket.”

This is an incredibly common misconception. While it’s true that the additional income may put you into a higher tax bracket, what’s not true is that the incremental income will put all of your income into that tax bracket. See the above explanations regarding how tax brackets work and what an effective tax rate is.

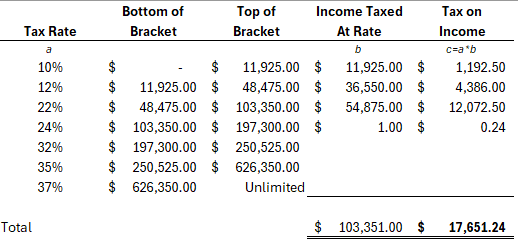

Let’s continue with our above example of a single taxpayer with taxable income of $103,351. They will not pay $24,804 in tax ($103,351 x 24%). Rather, their income tax calculation will look like the below:

As you can see from the above illustration, our single taxpayer friend will only pay $17,651 in tax, not $24,804. While moving into a higher tax bracket will make the next dollar of income more expensive, it will not put all of your income at risk. Said another way, if your employer wants to pay you more money, just say “thank you” and take it.

While the single taxpayer in this case is in the 24% bracket, their effective rate is only 17.08% ($17,651.24 / $103,351).

What is the highest tax bracket?

As of the time of this writing, the top tax bracket is at the 37% rate.

How do state income taxes work?

This is a tricky question as each state is different and not every state even has an income tax. However, if your state has a marginal tax rate, like South Carolina does, it will generally be consistent with everything stated above.

Conclusion

In conclusion, how income tax brackets work is commonly misunderstood. However, they are critically important to your tax and financial planning. A great tip is to make sure your tax preparer is explaining your marginal (tax bracket) and effective tax rates to you when they deliver your tax return.